If you are maxing out your regular 401(k) deferrals, making annual “backdoor” Roth IRA contributions, and still have additional funds to be put away for retirement, then making after-tax “mega backdoor” Roth 401(k) deferrals could be your next savings step. Those contributions can be incredibly impactful in helping you arrive at retirement with a large tax-free account.

A traditional 401(k) deferral provides a tax deduction, but all withdrawals at retirement are subject to ordinary income tax rates. You will later pay taxes when withdrawing both contributions and investment earnings; this is similar to a traditional IRA.

Roth 401(k) deferrals work in the opposite direction - there is no tax deduction for a contribution, but qualified withdrawals of both contributions and investment earnings are tax-free; similar to a Roth IRA.

If you are familiar with the concept of a “backdoor” Roth IRA contribution, you can probably guess that the “mega” version provides a possibility for a larger contribution while carrying similar tax advantages. A “backdoor” Roth IRA contribution is limited to $7,500 for 2026 ($8,600 if you are over 50), while you can add up to additional $47,500 to your Roth 401(k) account through the “mega backdoor” Roth 401(k) contribution.

Once you have maxed out your regular 401(k) contributions for the year, and if your 401(k) plan allows, you can make additional non-deductible after-tax contributions with a subsequent conversion to Roth 401(k) or a rollover to a Roth IRA. You are putting after-tax non-deductible funds into your retirement account, and then converting them into a Roth account, just like with a “backdoor” Roth IRA contribution. Majority of larger tech companies offer this feature in their 401(k) plans, but it’s not as common in other industries.

If instead of making those contributions, you decided to invest the funds in your regular brokerage account, all investment earnings would be subject to income taxes. Earnings in a Roth account are not subject to income taxes. That is the “mega backdoor” Roth magic, particularly valuable if you are looking at a long investment horizon with years of compounding.

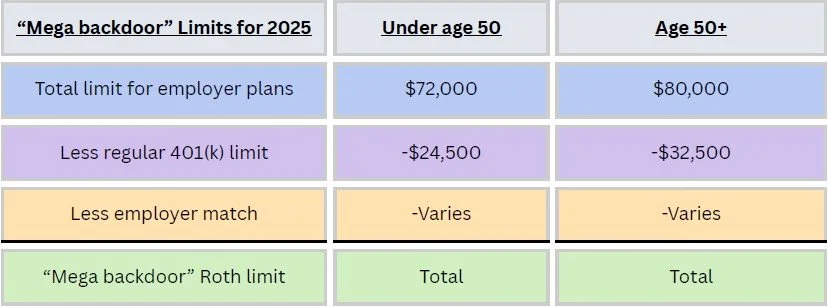

In order to figure out the maximum you can invest via the mega backdoor Roth method per year, you will need to subtract your regular 401(k) deferrals and the employer matching contributions from the total allowable amount - $72,000 for 2025 ($80,000 if over 50).

Note that an IRA contribution with a 2026 limit of $7,500 ($8,600 if over 50) is a separate opportunity in addition and unrelated to the $72,000 ($80,000 if over 50) employer-sponsored plan limit.

A few things need to be in place in order for this to work:

The 401(k) plan needs to allow after-tax contributions and be able to keep track of them separately, and

The 401(k) plan needs to either be able to roll those contributions into your Roth balance within the plan, or allow in-service withdrawals so that the funds can be transferred to your Roth IRA.

If you work for a larger tech company, the conversion of the post-tax contributions is likely automatic, as long as such an election is made. Try logging into your 401(k) plan account and checking your elections, often in the same screen as where you select 401(k) deferral amounts.

If your 401(k) plan allows for after-tax contributions but does not provide automatic Roth conversions, it needs to allow in-service distributions to a Roth IRA. You will have to manually request an in-service trustee to trustee distribution and get the funds into your Roth IRA.

It’s worth mentioning that pro rata Roth IRA conversion rules do not apply to after-tax 401(k) --> Roth IRA conversions, as long as only after-tax contributions get converted to Roth balances within the plan. This means that if you have a traditional IRA that was funded with tax-deductible contributions, you can still take advantage of “mega backdoor” Roth 401(k) contributions without triggering taxable income, unlike in the case of “backdoor” Roth IRA contributions.

You can do both a “backdoor” Roth IRA and a “mega backdoor” Roth 401(k) contribution for the same tax year; one does not exclude the other. The 401(k) contributions need to be done before the end of the year, while the IRA ones can be done before April 15 of the following year (until the due date of the tax return for that year).

If you would like to learn more about retirement savings strategies, take a look at our collection of posts on the topic.